.png)

Mintyfi Dashboard

About

Mintyfi simplifies financial management for individuals and small business owners by unifying accounts, tracking expenses, and streamlining finances in one powerful dashboard.

Category

Fintech

Role

UX and UI Desigmer

Type

Case study project for MIT

Enthographic Interviews

I conducted in-depth user interviews to explore behaviors and challenges, revealing key insights and opportunities for creating the platform.

How do you currently track your finances?

"I typically use spreadsheets, but keeping them updated takes forever and I often fall behind."

What kind of dashboard insights do you need most?

"I need a quick overview of my cash flow, income, expenses, and savings, all in one view."

Do you set financial goals? How do you monitor them?

"I create financial goals but struggle to track my progress because existing tools lack reminders."

What's your biggest financial challenge?

"My main struggle is syncing all my accounts, it's difficult to see my complete financial picture."

What would make managing finances easier?

"Smart suggestions tailored to my spending habits, not just generic alerts when I overspend."

What should the dashboard interface look like?

"Clean, adaptable, and visually intuitive. I want insights without navigating through endless menus."

Competitor

Analysis

I analyzed four financial management dashboards to assess their insights, usability, and visualization capabilities, identifying strengths and opportunities for differentiation.

Pain Points

Gathered

Lack of budget planning support

Time-consuming manual data entry

Insufficient reminders and alerts

Confusing and outdated dashboard interfaces

Generic solutions that don't address individual needs

No incentives or motivation to save money

Inconvenient progress tracking

Absence of forecasting and future planning tools

Difficulty controlling spending habits

Limited visibility into recurring subscriptions and hidden fees

Problem and Solution

I identified the core problem of fragmented financial data and defined a solution: a unified, intuitive dashboard that streamlines management and provides actionable insights.

The Problem

Users struggle to manage their finances effectively due to fragmented transactions, lack of real-time synchronization, and inadequate insights leading to confusion, missed goals, and uninformed financial decisions.

The Solution

All financial data: balances, expenses, income, and transactionsis consolidated into a streamlined dashboard with clear categorization and consistent layouts to enhance clarity.

The Solution

Integrated advanced analytics and personalized budgeting tools to deliver role-based insights for individuals, freelancers, and small businesses, ensuring seamlessly adaptation to each user's financial needs and goals.

User Persona

I identified needs to busy professionals and mapped a solution for them.

Empathy Mapping

Mapped what users say, think, do and feel to uncover pain points and motivations, architecting a solution aligned to their real needs.

.png)

User

Stories

Revealed everyday struggle and goals, helping me design features that are truly aligned with the needs creating lasting impact and value.

As a freelancer, I want to generate quick invoices so that I can get paid faster without spending hours on paperwork.

John Hunt

Freelancer

As a young professional, I want to track my daily expenses so that I can stay within my monthly budget.

Emily Rose

Product Designer

As a traveler, I want multi-currency expense tracking so that I can manage my finances while abroad.

Charlie Joesph

Travel Enthusist

Information

Architecture

Low Fidelity

Prototype

High Fidelity

Prototype

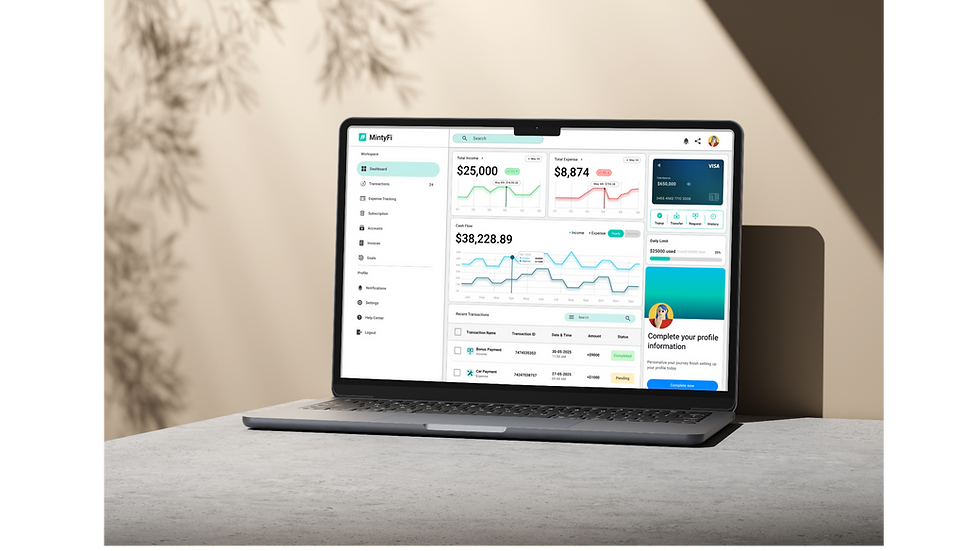

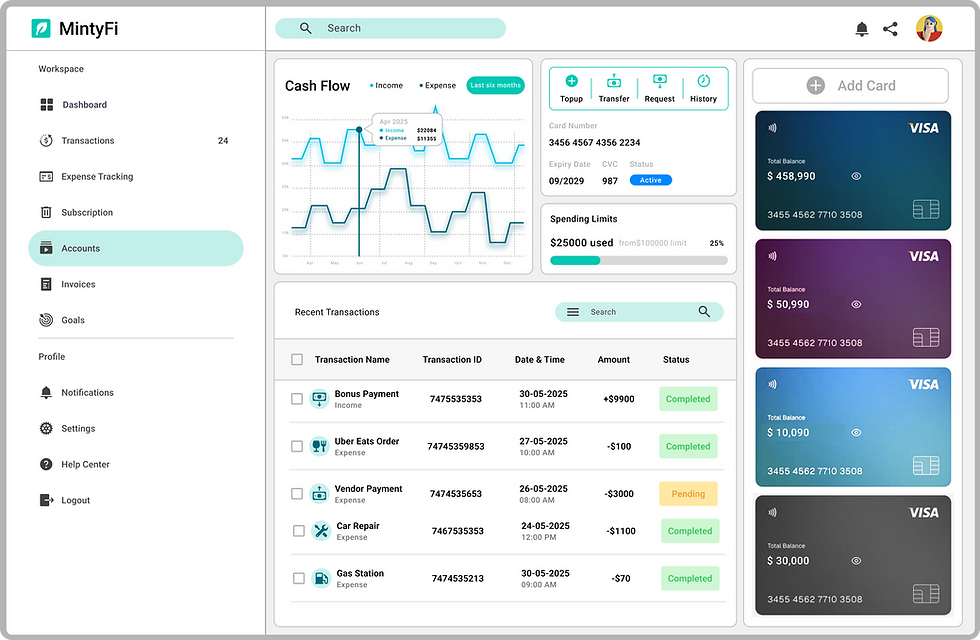

Dashboard

The Mintyfi Dashboard consolidates income, expenses, and cash flow, providing a clear overview of financial health. Integrated tools like transactions, subscriptions, and goals enable seamless tracking, while intelligent insights drive smarter money management.

.png)

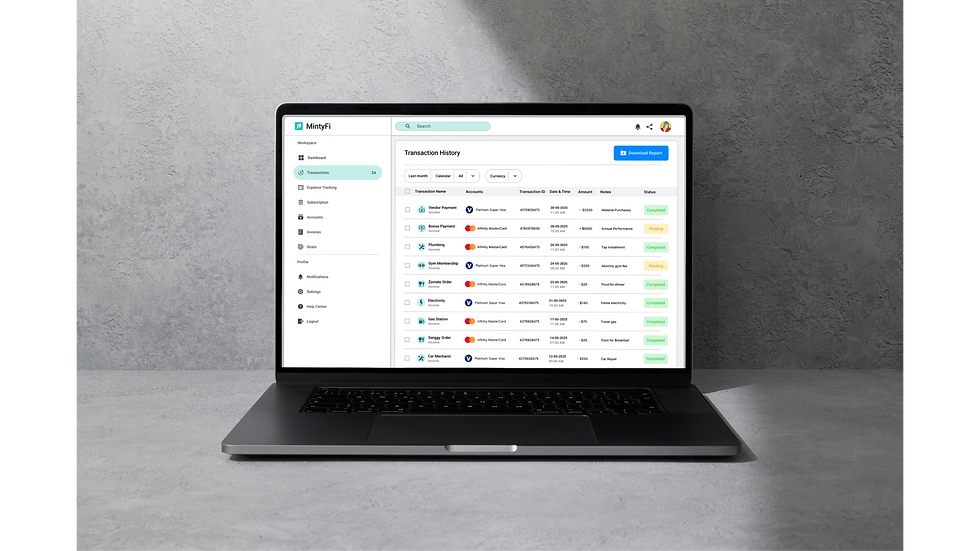

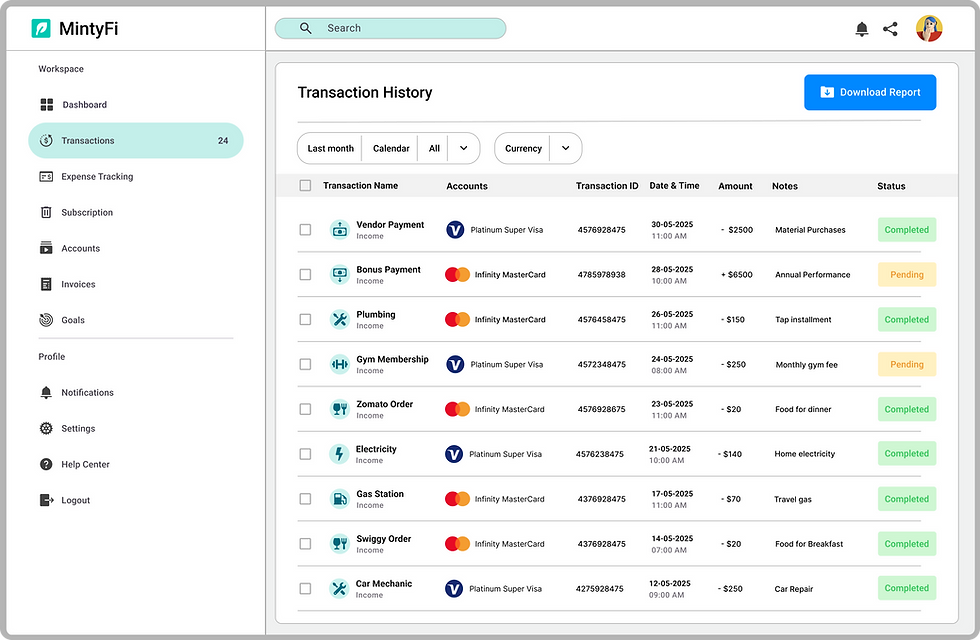

Transactions

Provides a transparent view of all financial activities with adaptable filters and instant access to details, making expense tracking seamless and efficient.

Expense Tracking

Delivers real-time insights into spending across categories, featuring clear visuals of recent expenses and key trends to help users effectively manage their financial health.

.png)

Subscription

Offers a comprehensive view of active and inactive plans with intuitive filters and streamlined management options for enhanced control.

Accounts

Screen displays detailed information on card balances, spending limits, and cash flow patterns. With instant access to transactions and account activity, users can manage their finances easily.

Invoices

Delivers a comprehensive view of all bills with status indicators, filters, and quick actions, making payment tracking straightforward and well-organized.

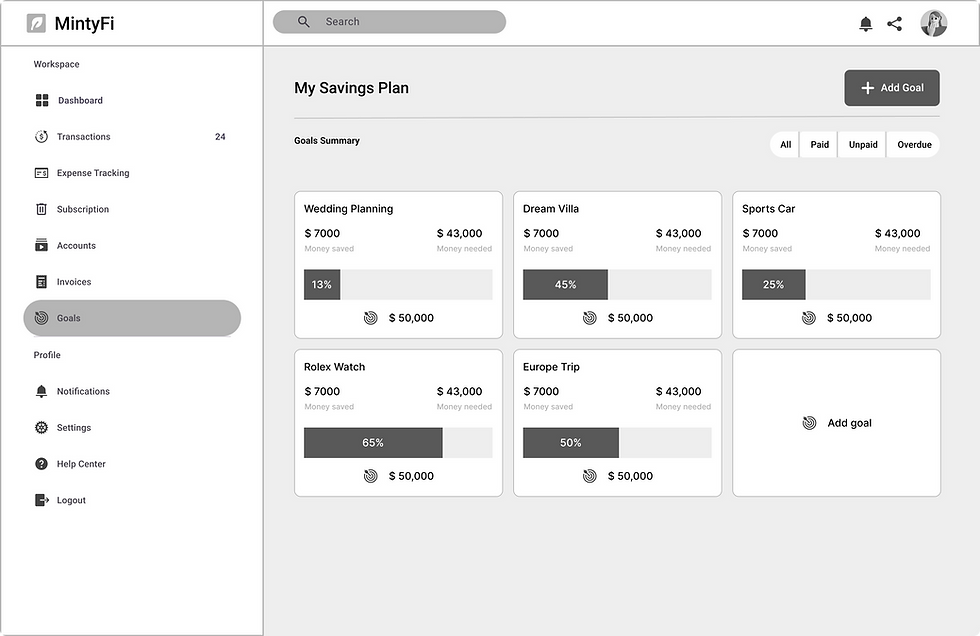

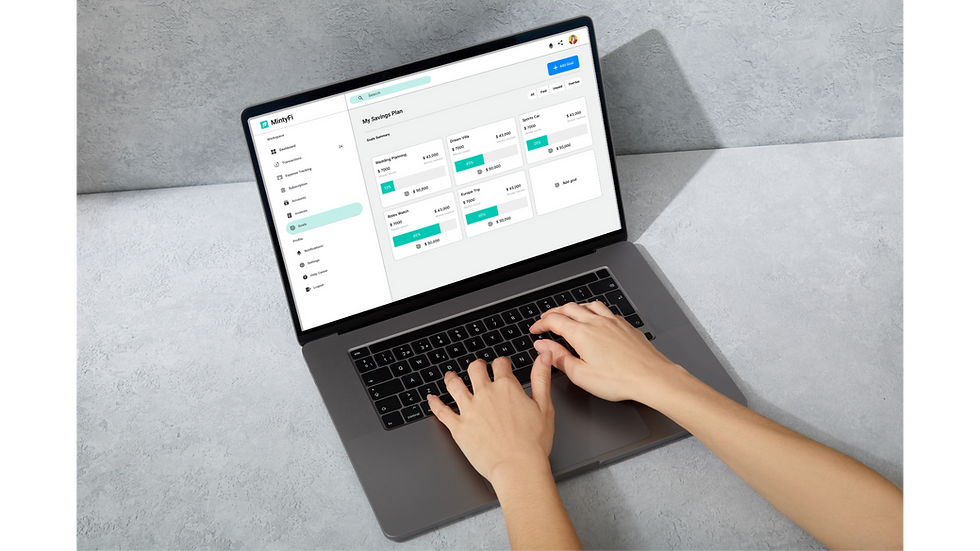

Goals

Enables users to monitor savings progress through clear visuals and status indicators. Simplified goal management and real-time updates support better financial planning and control.

Usability

Testing

Usability Testing helps identify user pain points, validate ease of use, and refine task flows to improve the overall experience.

This usability test was conducted with a group of 18 business users, including small business owners and finance managers. The objective was to identify usability challenges, evaluate task efficiency, and gather insights to enhance the overall business experience.

Participants were asked to perform essential financial tasks such as tracking company expenses, managing recurring subscriptions, setting savings or revenue goals, and reviewing invoices. Their feedback provided valuable input on clarity, functionality, and overall satisfaction.

Results

16 out of 18

Users efficiently tracked and categorized expenses, finding the workflow smooth and intuitive.

18 on 18

Effortless goal setting and progress tracking with visual dashboards.

14 out of 18

Users recommended adding cash flow forecasts and budgeting tips to support smarter decisions.

Learnings

Based on user feedback, the next phase will focus on integrating cash flow forecasting, personalized budgeting recommendations, and enhanced financial guidance to empower users with actionable insights.

Working on this project at MIT alongside finance professionals deepened my understanding of balancing simplicity with functionality. It reinforced that effective UX design builds trust, reduces cognitive load, and empowers confident decision-making, strengthening my commitment to human-centered design in high-impact domains.